Investment Strategy

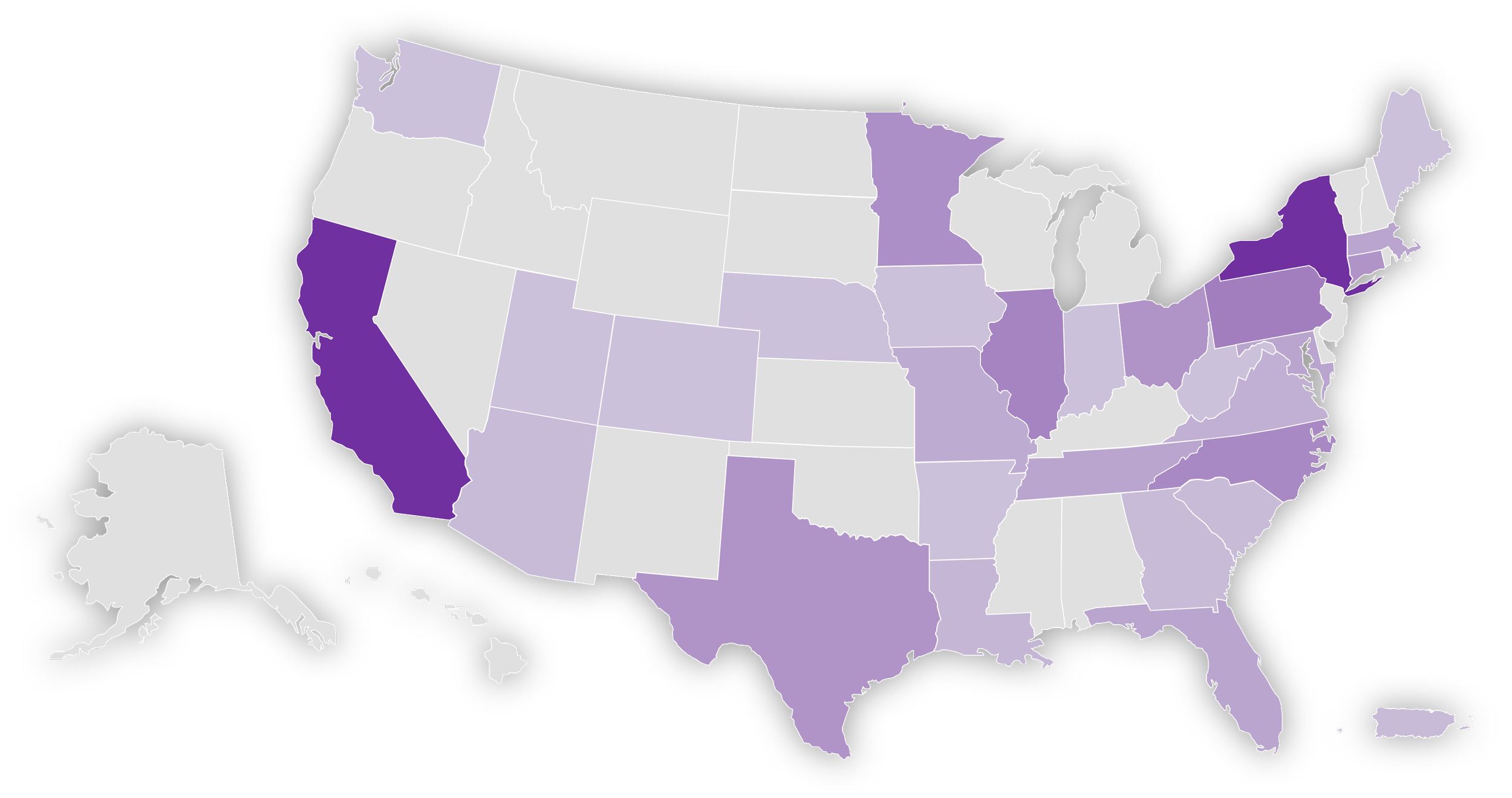

Small Business Investment Company (SBIC) funds drive economic growth across regions supporting businesses across most states, promoting growth in diverse regions and ensuring equitable access to capital. White Wolf Lower Middle Market Access is a private investment firm focused on building portfolios of select Small Business Investment Company (SBIC) funds.

Why SBIC Funds?

SBIC funds are private investment funds, licensed and regulated by the U.S. Small Business Administration (SBA), with access to SBA financing at attractive rates and terms. Other benefits of SBICs include:

Rigorous vetting and regulation by the SBA, with fewer than 35% of applicants receiving SBA approval;

WW LMMA only invests in SBICs focused on profitable, lower middle market companies, which historically has led to lower loan default rates;

Less competitive deal environment – better loan rates and terms than larger private borrowers produces investments with less leverage at the borrower and typically with strong equity cushion and focused owner/operators;

Combination of attractive government-sponsored leverage on attractively priced credit assets leads to stronger returns than non-SBIC private credit strategies.

Why White Wolf LMMA?

White Wolf Lower Middle Market Access is a partner of White Wolf Capital Group, a private investment firm focused on lower middle market companies in North America which makes both direct and indirect investments.

White Wolf’s experience and relationships help enable sourcing, diligence, and favorable partnerships with SBIC fund managers.

LMMA has a dedicated, experienced investment and risk management team with decades of quantitative and fundamental credit portfolio management and valuable asset-management business experience.

The cyclicality of SBIC fund availability provides an ongoing opportunity: each Fund Series selectively invests in a highly diversified portfolio of SBIC funds typically with experienced managers and strong track records.

Potential access to additional attractive secondary investments in SBIC funds.

Provides institutional investors and wealth management firms with a turnkey, differentiated, well vetted, risk managed, and diversified product offering, offering exposure to an under-represented niche asset class with strong historical outperformance.

.

Summary Strategy Statistics of typical LMMA Fund Series

8-12 underlying SBIC funds

Long-tenured, cohesive investment teams

100+ experienced investment professionals

Diversified sourcing, sector, and capital structure tactics

Institutional-quality platforms

Robust back office and transparent reporting

Meaningful alignment of GP/LP

~150 underlying portfolio companies

~10x the typical private credit portfolio

Average < $1m exposure per underlying company

Benefits of efficient highly diversified deal sourcing and underwriting across regional and industry expertise of underlying managers